Vietnamese edtech VUIHOC eyes fresh funds after DBJ Capital backing

Source: DealStreetAsiaVietnamese edtech startup VUIHOC—backed by Do Ventures, TNB Aura, and BAce Capital, among others—is looking to raise fresh funds to consolidate the company’s position in the K-12 education market, and promote the R&D of AI application products, DealStreetAsia has learnt.

The startup is looking to raise $10-20 million in a Series B round.

VUIHOC, in September, completed a Series A+ round from DBJ Capital, the venture capital arm of the Development Bank of Japan Group (DBJ), marking its first deal in a Southeast Asian edtech startup. The round was also participated in by Vivendus Capital, an investment company that specialises in emerging global markets, the company confirmed to DealStreetAsia.

“This Series A+ round allows us to both upgrade our existing products and invest in a new generation of AI tools that help teachers and students learn more effectively,” said Do Ngoc Lam, VUIHOC’s co-founder and CEO.

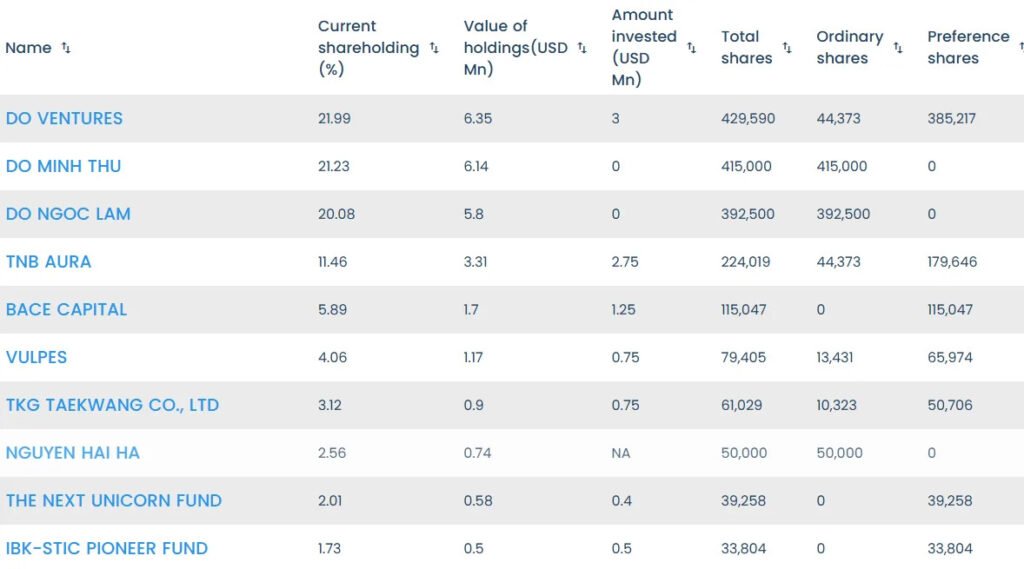

Do Ngoc Lam and co-founder Do Minh Thu hold 20.1% and 21.2% stakes, respectively, in the startup, according to DealStreetAsia DATA VANTAGE.

VUIHOC’s top shareholders

The top shareholder, with a nearly 22% shareholding, is Vietnamese VC firm DoVentures, which has been on VUIHOC’s cap table since 2022.

VUIHOC—Vietnamese for ‘fun learning’—claims to have served more than 1 million students across Vietnam since its inception in 2019.

Its ecosystem spans online learning, test prep, and language training under three brands —VUIHOC, which offers K-12 courses aligned with Vietnam’s national curriculum; Rino, which provides AI-powered personalised learning; and The IELTS Workshop (TIW), which focuses on IELTS and academic English.

With over 75% of users outside major cities, VUIHOC is helping bridge the education gap and improve learning outcomes nationwide.

In 2023, the startup raised $6 million in a funding round led by Southeast Asia-focused VC firm TNB Aura. The round also saw participation from TKG Taekwang, IBK-STIC Pioneer fund, Do Ventures, BAce Capital, and Vulpes. A year later, the edtech startup made a strategic investment in English language teaching chain The IELTS Workshop in a seven-digit USD transaction.

VUIHOC’s new investor DBJ Capital—founded in June 2010 through the integration of two VC firms of the DBJ Group, New Business Investment and Intellectual Properties Development & Investment—focuses on venture firms that use new technologies and 2/3 business models to grow and compete in the global market, regardless of their industry or scale.

DBJ is not new to the Vietnam market. In 2020, local brokerage SSI Securities partnered with Thailand’s largest private company CP Group, and DBJ to launch a $150 million private equity fund to invest in Vietnam.

DBJ plans to take a more selective approach in its 2025 private equity commitments in Southeast Asia after an active 2024, per a report by Private Equity International. DBJ will target mid-sized funds with investment tickets of $20-30 million, often taking the role of anchor investor, added the report. The bank is particularly focused on Vietnam, Thailand, and Indonesia, citing strong growth potential, and prefers fund managers with proven track records and regional expertise.

A darling of investors during the COVID-19 pandemic, when schools and colleges were shut down, edtech has fallen out of favour in recent times. Yet a few startups in the sector continue to raise funds.

In June, Vietnamese education technology company Galaxy Education (GE) secured nearly $10 million from East Ventures and other investors. In May last year, DealStreetAsia had reported that Galaxy Education was in the market to raise about $10-20 million in fresh funding to scale its business.

Early this year, Kyna English announced the completion of its Series B funding round anchored by private equity firm Asia Business Builders (ABB). Other edtech startups that raised funds last year include Prep, NativeX, and Kapla Vietnam.

In India, meanwhile, PhysicsWallah, whose backers include WestBridge and Hornbill Capital, filed for an initial public offering worth Rs 3,820 crore ($437 million) last month. India’s edtech industry has faced a challenging few years as SoftBank-backed Unacademy and Tiger Global-backed Vedantu cut staff while Byju’s US lenders pushed the startup, once worth $22 billion, towards insolvency.

Written by: Quynh Nguyen

Edited by: Pramod Mathew