The Future of VC Due Diligence

In today’s investment climate, venture-backed companies are expected to demonstrate not just speed and ambition, but control, accountability, and resilience. As businesses scale, weaknesses in areas such as data protection, labor practices, governance discipline, or environmental exposure can quickly translate into regulatory scrutiny, reputational damage, or delayed exits. These risks are often invisible in early financial performance, but materialize as companies grow.

Historically, ESG considerations in venture capital were treated as peripheral, secondary to financial, legal, or technical diligence, or postponed until later stages. As regulatory requirements tighten and stakeholder expectations evolve, this approach is increasingly misaligned with how companies are assessed and financed. ESG due diligence has therefore emerged as a critical strategic tool for surfacing material risks early and assessing whether a company’s operating foundations are strong enough to support sustainable growth.

Why ESG Due Diligence Matters

The value of ESG due diligence lies in its ability to provide holistic visibility into how a company actually operates, beyond what financial performance or legal structure alone can reveal.

For investors, this visibility is critical. ESG due diligence helps identify execution risks early, when they are still manageable, and reduces the likelihood of issues emerging during later funding rounds or exit processes. Embedding ESG early is therefore about “future-proofing”, protecting and enhancing long-term portfolio value. Early integration establishes governance structures and accountability systems that reduce future compliance costs and give investors confidence as companies scale.

For companies, ESG can feel premature at the early stage, but embedding these foundations early signals strong governance, simplifies future compliance, and surfaces opportunities to improve efficiency. Rather than adding complexity, ESG due diligence reduces friction over time, provides practical operational insights, and positions companies more competitively for follow-on funding, partnerships, and eventual exit.

What ESG Due Diligence Looks Like for Early-Stage Companies

Since 2020–2021, ESG due diligence in VC has evolved from a box-ticking exercise into a materiality-based evaluation. Investors now assess ESG risks with the same rigor as financial and legal factors, focusing on risk exposure, baseline controls, and improvement priorities aligned to the company’s business model and value chain.

For early-stage companies, the expectation is not to have complex systems, but to demonstrate control and accountability through foundational practices. Baseline policies and procedures such as clear labor and health and safety standards, basic environmental management approaches, data privacy safeguards, and channels for reporting grievances or ethical concerns, indicate that the company can manage risk responsibly today.

How TNB Aura Leads in ESG Due Diligence

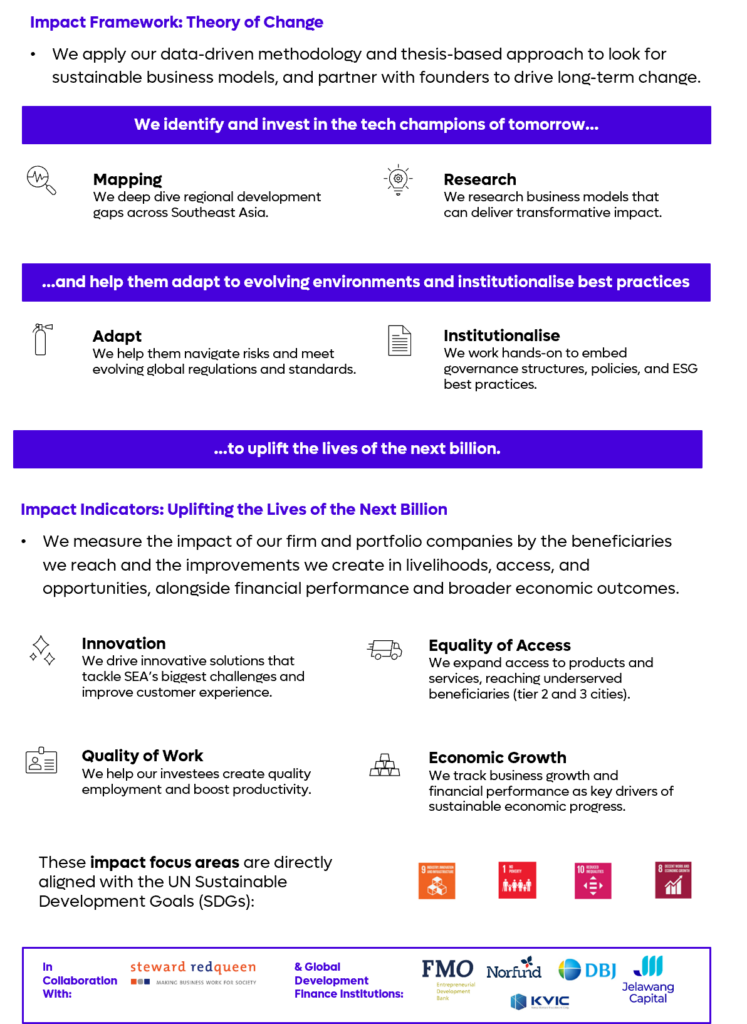

At TNB Aura, ESG due diligence is a core part of our investment process and a key enabler of our impact strategy. It ensures our investments align with our priority Sustainable Development Goals (SDGs 1, 8, 9, and 10) and our Theory of Change: to identify and invest in the tech champions of tomorrow, and help them adapt to evolving environments and institutionalize best practices to uplift the lives of the next billion.

Each company is initially assessed and assigned an Environmental & Social (E&S) risk category based on sector, operating context, and potential exposure. This guides the depth of diligence applied. For companies assessed as medium risk (B) or higher, external ESG specialists may be engaged for deeper, sector-specific analysis. Our approach combines desk-based assessment with on-site validation, using proprietary tools aligned with IFC Performance Standards and Consumer Protection Principles to evaluate the effectiveness of the company’s policies and internal controls..

What sets TNB Aura apart is its commitment to hands-on support after investment. We treat ESG due diligence as a starting point for institutionalization, not an endpoint. Working closely with founders, we translate findings into practical ESG Action Plans that prioritize key risk areas and are appropriate for stage and capacity. Recognizing the resource and capacity constraints common at early stages, we support execution through tailored templates, playbooks, and other tools across operations, team, risk management, governance and compliance, and stakeholder engagement. We help companies embed ESG into day-to-day execution, building the discipline needed to scale and create long-term value without adding unnecessary complexity.

ESG Due Diligence Looking Forward

The growing emphasis on ESG due diligence in venture capital reflects a fundamental shift in how risk, value, and readiness are assessed. As capital markets, regulators, and acquirers raise expectations, the ability to demonstrate control and accountability is becoming as important as growth itself. TNB Aura’s approach is intentionally pragmatic, pairing rigorous assessment with hands-on support that helps founders institutionalize best practices in a way that is fit for stage and execution-focused. Companies that embed these foundations early are better positioned to scale responsibly and navigate future complexity, while those that defer institutionalization face steeper costs and challenges in catching up.