Perspectives: Insurtech

A Deep Dive Into the Insurtech Market

Understanding Southeast Asia’s Insurtech landscape through diving into the following:

- The Global Insurance Market and Value Chain

- Priority Business Models and Key Success Factors of Global Precedents

- Insurtech Opportunities in Southeast Asia

Insurance Requires Digital Transformation and Omni-Channel Innovation

Rising demand for digital insurance products is reshaping the industry. Today, 3 core Insurtech models are emerging to create, distribute, and enable insurance in a rapidly evolving market.

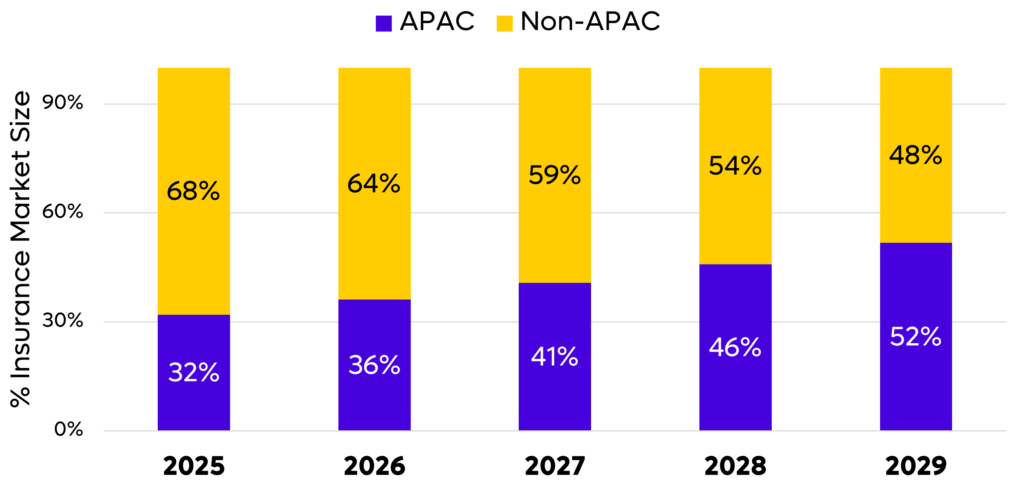

Fig 1. APAC vs Non-APAC Insurance Market

Global Insurtech Market Overview

The global insurance industry is valued at around $11.6 trillion in 2025, with APAC contributing approximately $3.7 trillion, or 32% of the global market (refer to Fig 1, this figure compares the size and growth of the APAC vs Non-APAC insurance market). While the global market is projected to grow at a steady 2.9% CAGR from 2017 to 2029, Southeast Asia is expected to expand faster at 4.3% CAGR over the same period. By 2029, the global insurance market is projected to reach about $9 trillion.

The following are the market’s key drivers:

- Growing Demand for Digital Insurance: Higher smartphone usage and digital adoption, especially among younger consumers, are accelerating the shift toward faster, convenient, tech-enabled insurance solutions.

- Omni-Channel Access Expanding Reach: The integration of offline agents with digital platforms allows insurers to engage customers across their preferred channels, increasing accessibility for products such as travel, motor, and health insurance.

- Supportive Regulatory Environments: Regulatory sandboxes across the region give Insurtechs a safe space to test new concepts, such as parametric* or embedded insurance, helping them refine products and enter markets more quickly while maintaining consumer protection.

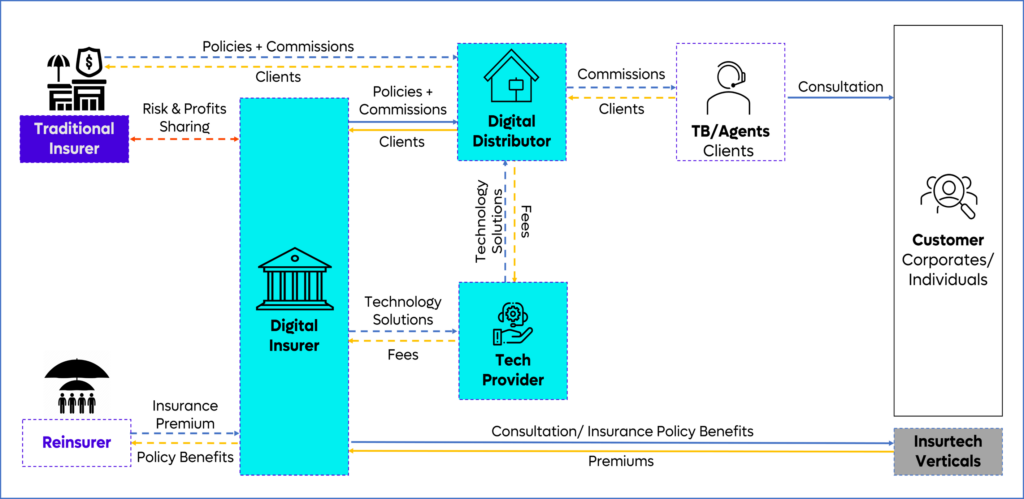

Fig 2. Insurtech Value Chain

Business Models in the Insurtech Space

The Insurtech ecosystem has evolved into several distinct models, each addressing different parts of the insurance value chain (refer to Fig 2, this figure maps the relationships among key Insurtech players). These are the 3 most common approaches used by companies reshaping the industry today.

- Full-Stack (Digital Insurer): These companies build and underwrite their own insurance products. They often use a direct-to-consumer approach while partnering with traditional insurers and reinsurers to share risk and broaden product offerings.

- Digital Distributor: These platforms sell insurance online using automation and user-friendly interfaces. They provide faster service and wider reach than traditional agents, making it easier for consumers to compare and purchase coverage.

- Tech Provider: These players supply the software, APIs, and analytics that power digital transformation for insurers and distributors. They help improve efficiency, customer experience, and decision-making across the insurance value chain.

Digital Insurers and Distributors Have Both Seen Multiple Unicorn Outcomes

Key characteristics include omnichannel distribution and expansion of product portfolios to boost profits and enhance appeal to younger consumers

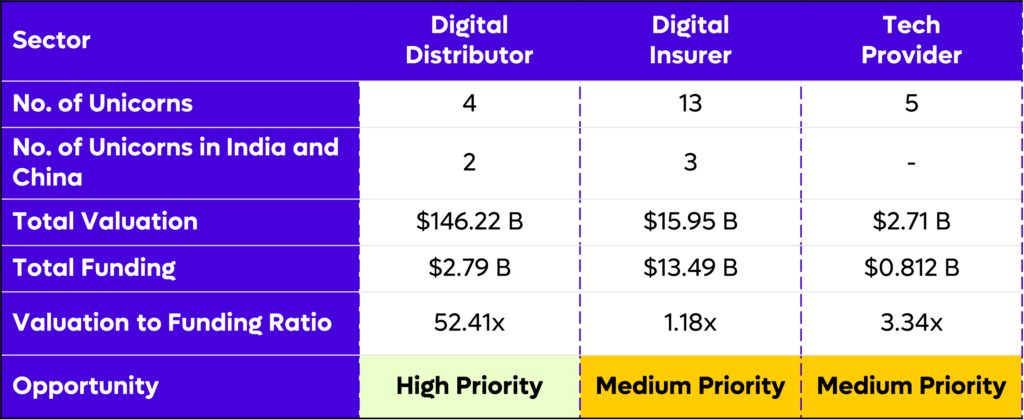

Fig 3. Business Model Side-By-Side

Priority Business Models

Fig 3 shows a side-by-side comparison of 3 high-potential Insurtech business models, selected based on total funding, valuation, and emerging market precedents.

Key insights from this analysis include:

- Digital Distributors: Valued at $146.22 billion with a 52.41x valuation-to-funding ratio, digital distributors scale quickly through user-friendly online platforms. Their success stems from customers’ preference for fast, convenient access to insurance and insurers’ ability to improve distribution efficiency.

- Digital Insurers: With $13.49 billion in funding, 13 unicorns (including 3 in India and China), and a total valuation of $15.95 billion, digital insurers attract investors through tech-enabled insurance solutions. Their growth is driven by faster claims processing and tailored products that meet the needs of emerging markets.

- Tech Providers: This segment lags on most metrics, with no unicorns in India or China, a lower total valuation of $2.71 billion, and a valuation-to-funding ratio of 3.34x. Tech providers primarily support other players rather than serve customers directly, making them a medium priority.

Based on these findings, Digital Distributor and Digital Insurer were prioritized for a deeper dive.

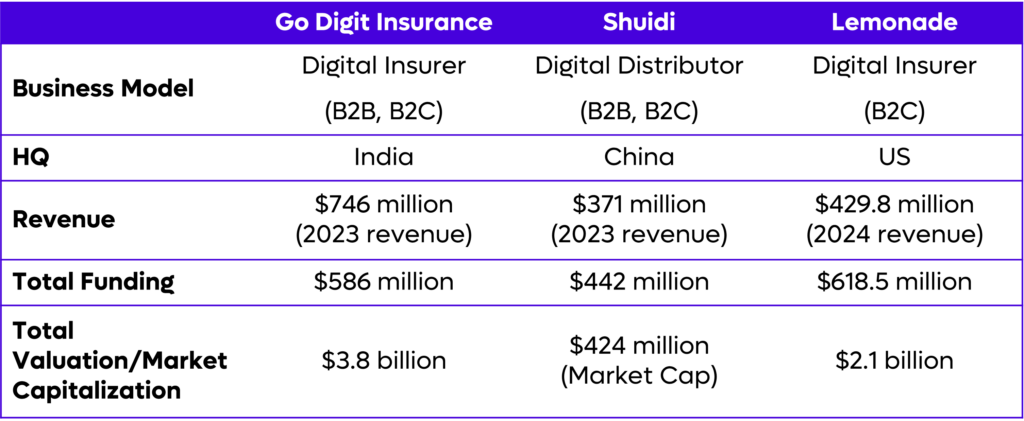

Fig 4. Case Studies

Global Key Takeaways

Fig 4 highlights three global precedents used as case studies to identify success factors in sustaining growth in the Insurtech space.

Key findings include:

- Product Focus: Concentrating on automotive and health insurance drives sustainable growth as seen with companies like Go Digit Insurance. The market is dominated by direct-to-consumer (D2C) and B2B2C models, while white-label and embedded insurance currently have more limited impact.

- Go-to-Market (GTM) Strategy: Omnichannel distribution, combining digital platforms with in-person support, meets the expectations of younger consumers for convenient, seamless access. Lemonade exemplifies how offering multiple channels enhances engagement and customer satisfaction.

- Revenue and Unit Economics: A careful balance between offline agent networks and online platforms is critical for profitability. Offline networks typically incur higher operational costs but generate greater revenue, as demonstrated by Shuidi and Go Digit Insurance.

The Southeast Asian Insurtech market remains open for a regional champion

Players with strong products for underserved segments, backed by omni-channel distribution, smooth claims, and solid partnerships, will be best positioned to lead SEA’s insurance market.

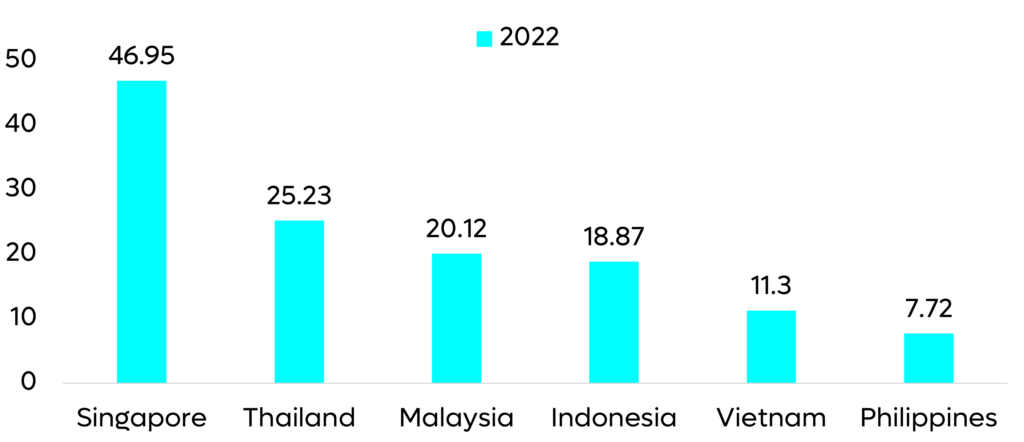

Fig 5. Total Insurance (GWP, $billion)

Opportunities in Southeast Asia

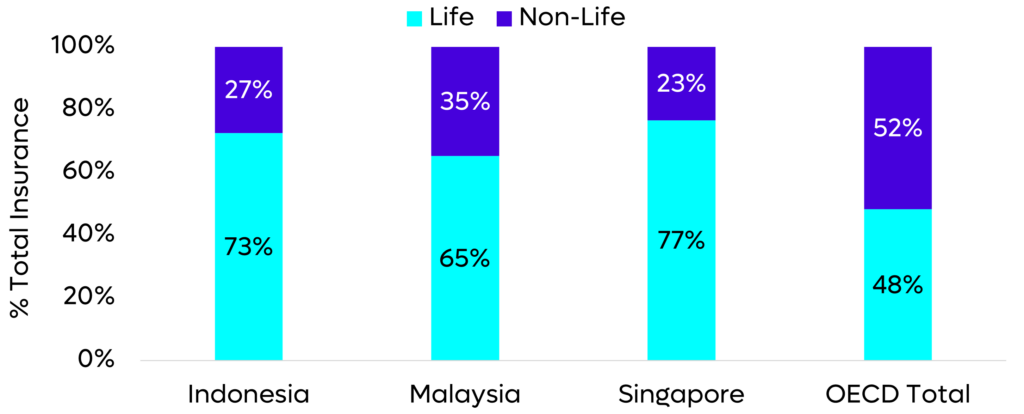

Insurance penetration in Southeast Asia remains relatively low (3.9% vs. the global average of 7.1%), with a skew toward life insurance (63% of total premiums). Non-life penetration is significantly below global levels (1.1% vs. 3.9% globally). Figure 6 illustrates the premium composition by comparing the ratio of life vs non-life insurance in SEA vs the OECD total. Insurance density remains low in emerging markets such as Indonesia and Vietnam, while Singapore ranks 4th globally. This disparity highlights a wide regional gap and substantial room for growth, particularly in non-life categories. Figure 5 quantifies this large, untapped opportunity by showing the market’s total GWP in $billion.

Several factors are creating fertile ground for regional Insurtech leaders to emerge:

- Rapid Digital Adoption: High mobile usage and fintech adoption are shifting consumer preference toward digital insurance channels. This allows insurers to reach younger customers with more seamless, convenient, and personalized offerings.

- Rising Awareness and Demand: As the middle class grows and financial literacy improves, demand for insurance continues to rise, particularly in non-life segments such as health, motor, and property. With life insurance dominating premiums today, this creates clear opportunities for diversification and growth.

Fig 6. Life and Non-Life in SEA vs OECD Total

Key Takeaways for Insurtech in Southeast Asia

- Strong Product Development: Successful Insurtechs tend to start with a simple flagship product before expanding into more regulated, higher-premium categories. This gradual approach helps build credibility and consumer trust.

- Omnichannel as the Ideal GTM Strategy: A combined online–offline presence is essential for customer acquisition and scale. Growth is driven by offering simple, low-premium products, simplifying claims, and forming strong partnerships across the value chain.

- Claims Rate Impact on Revenue: Claims ratios significantly shape unit economics, with gross claims often exceeding 50% of revenue. Markets with lower claims rates (such as Vietnam at around 25%) tend to yield higher profitability. Effective claims management is therefore critical to financial performance.

- Targeting Underserved Segments: Focusing on young and underserved populations (ages 19–35) and building platforms that support multiple products over time boosts both growth and retention. Closed-loop platforms improve stickiness and maximize lifetime value by making cross-selling seamless.