Perspectives: Furniture & Interior Design

A Deep Dive Into the Furniture & Interior Design Market

Understanding Southeast Asia’s Furniture & Interior Design Landscape through diving into:

- Global Furniture & Interior Design Overview

- Business Models in Furniture & Interior Design

- Southeast Asia Furniture & Interior Design Overview

Furniture & Interior Design Goes Omnichannel as Consumer Behaviour Shifts

Technology facilitates improved supply chains as well as enhanced customer experience in the market

Furniture & Interior Design Global Market Size & Drivers

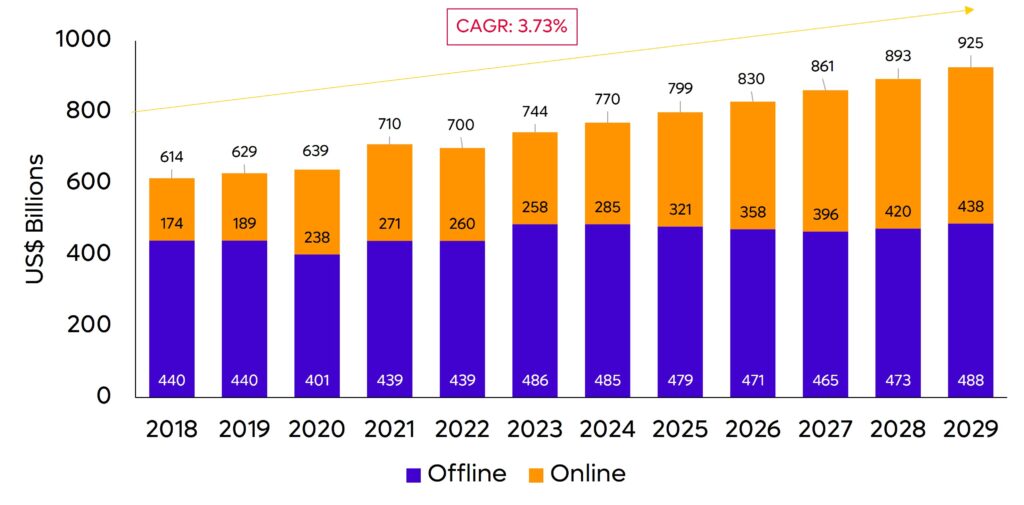

Fig 1. Global Furniture Market Size by Sales Channel

As shown in Figure 1 the global furniture market was valued at $770B in 2024 and is growing at a CAGR of 3.73%. Offline channels still make up a significant portion of the market size though online distribution drives the growth of the entire Furniture and Interior Design space. Notably, living room furniture & home décor contribute the largest to the industry’s market value, further driven by the following growth factors:

- E-Commerce Ecosystem: Convenience & accessibility empowers D2C frameworks, allowing consumers to have wide access to products, expanding the industry in revenues.

- Urbanization & Housing: Continual real estate development, commercial & residential housing results in consistent furniture demand.

- Lifestyle Shifts: Younger generations affect design, and manufacturing trends (e.g. compact, multifunctional, sustainable, etc.) to further align with their current context (e.g. smaller homes, societal trends, etc.).

Value Chain & Business Models

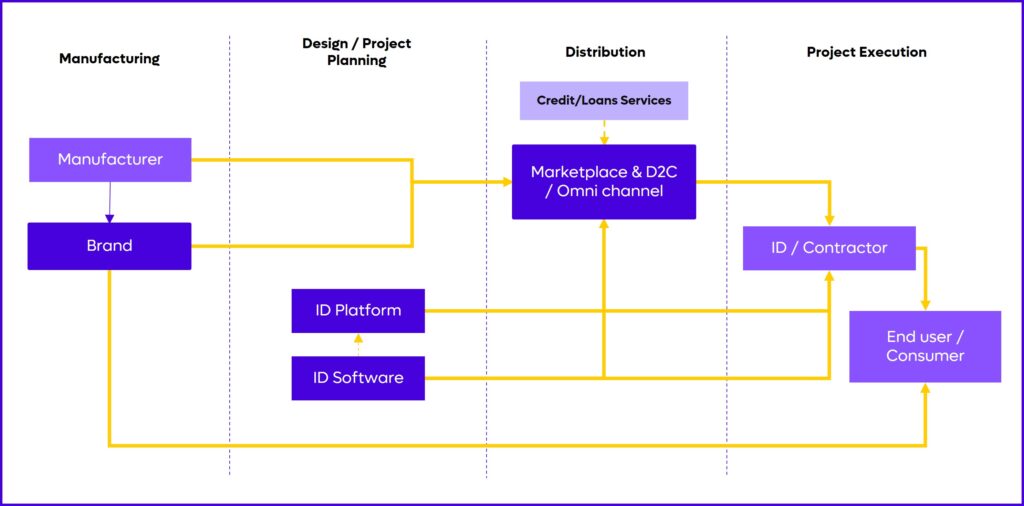

Fig 2. Furniture & Interior Design Value Chain

Figure 2 illustrates the Furniture & Interior Design value chain, showcasing how brands, manufacturers, and designers enable consumer access. The value chain highlights how D2C models can support marketplace and omnichannel strategies. Based on sector analysis, key business models include the following:

- Furniture Brand & OEM: Design, manufacture, and sell directly; revenue depends on product sales and requires high capital investment.

- Furniture Marketplace: An intermediary platform where brands and sellers can list their products; earns from product sales, subscriptions, and financing models.

- Interior Design Platform: Connects interior designers with consumers; revenue comes from consultations, product sales, and branding fees.

- Interior Design Software: Offers design visualization tools (e.g., AR, 3D) to designers and consumers; operates on a subscription-based model

The Furniture Industry Moves Towards Online Adoption and OEM models

Businesses should utilize technology to optimize operations, establish branding and offer customized solutions to have a long-term competitive position.

Marketplace & Furniture Brands Models Opportunities

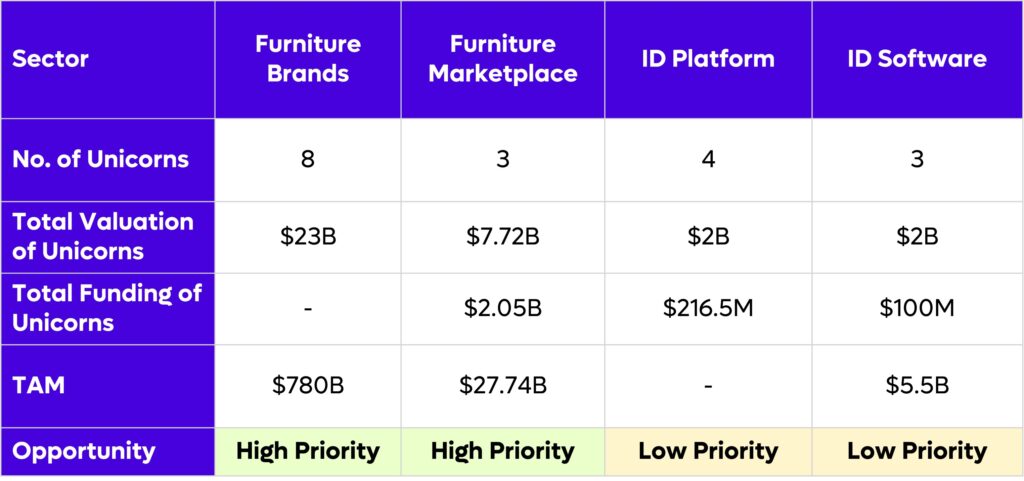

Fig 3. Sector Side-By-Side

Based on Figure 3, furniture brands and marketplaces show the largest traction, with the highest valuations and the most number of unicorns produced globally. On the other hand, Interior Design platforms & softwares remain a niche market with minimal opportunities.

- Furniture Brand: Global brands have medium to high prices and medium customizability, hence local brands have an opportunity to differentiate via affordability, and more customized solutions catered to local contexts. It should also be noted that Ikea takes up majority of traction within the Furniture Brands sector.

- Furniture Marketplace: Opportunities in expanding to financing & Interior Design consultation to lower buying barriers and acquire more customers. Moreover, partnerships with suppliers & manufacturers pose a significant opportunity to improve supply chain.

Additionally, it should be noted that Interior Design Platforms do not capture external transactions, while softwares require powerful tools with a strong userbase. Thus, the smaller addressable market for Interior Design softwares.

Global Key Takeaways of Furniture & Interior Design Industry

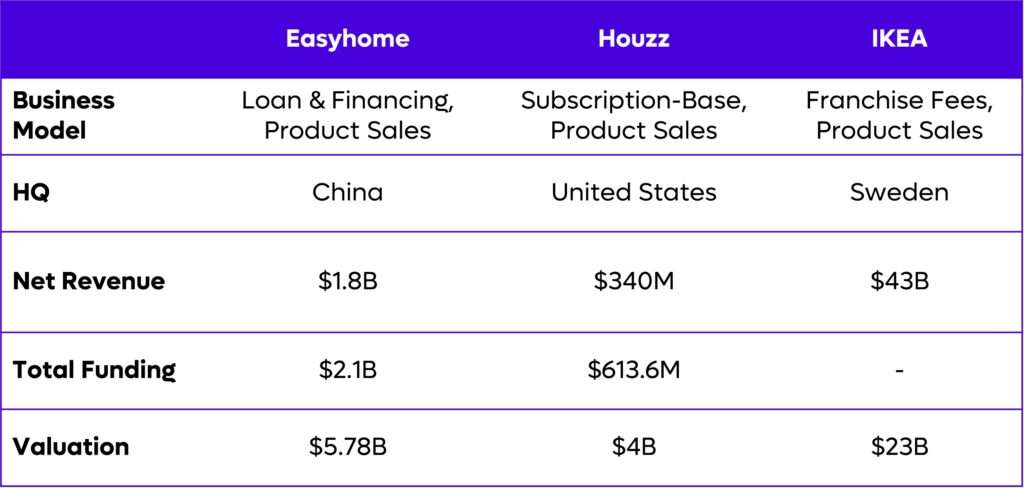

Fig 4. Case Studies

Figure 4 outlines established unicorns in furniture brands, and marketplaces, which have shown success through the key factors below:

- Competitive Edge of Global Brands: Global brands follow a traditional model while being superior in branding and reach. Established logistics and unit economics contribute to overall success, resulting in global brands winning in the category.

- Marketplace Expansion: Pure marketplace models must build their own brand and create a closed loop system in the value & supply chain to stay competitive. Additional value added services, such as financing, consultations, etc. are also essential for acquiring and retaining customers.

- Tech Enablement: Aside from uses in e-commerce and Interior Design services, this is also applied in the manufacturing process. Export-oriented markets such as China may have an edge in this.

Southeast Asia’s E-Commerce Infrastructure Elevates The Furniture Industry

There are strategic opportunities in optimizing operations through technology and utilizing the e-commerce ecosystem in SEA to gain traction & reach.

E-Commerce Rise in Furniture Sales in Southeast Asia

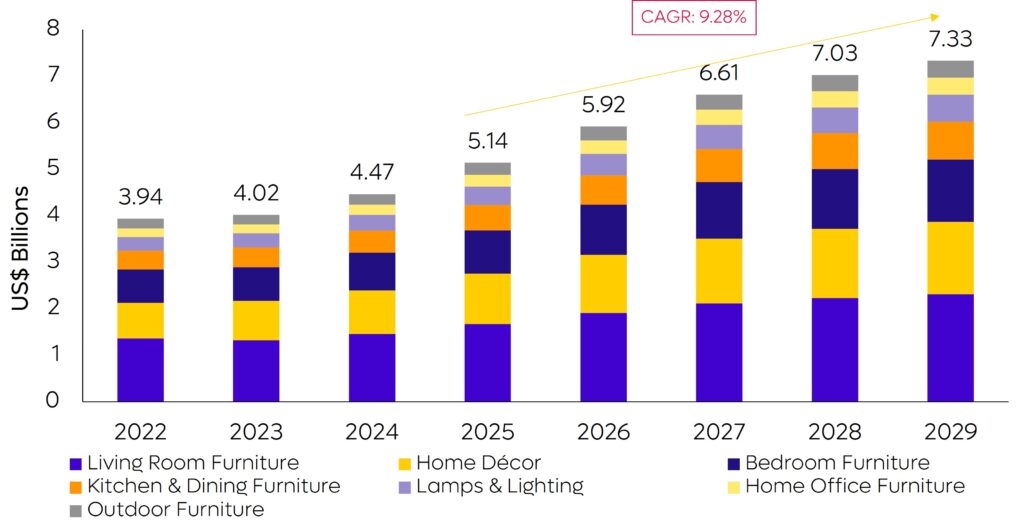

Fig 5. SEA Furniture E-Commerce Market Size Breakdown

Lazada and Shopee dominate e-commerce furniture sales in Southeast Asia. As shown in Figure 5, home décor, living room, and bedroom furniture are the top revenue contributors. In 2024, e-commerce furniture revenue reached $4.47B, with a projected annual growth of 9.28% in 2025 to 2029.

Based on market and consumer trends, several factors contribute to the growing furniture market in the region:

- Living, Dining, and Bedroom Furniture: Rising demand for space-saving, functional, and cost-efficient designs.

- E-Commerce Penetration: Social media and influencer marketing boost consumer engagement, while platform accessibility and variety drive online sales growth.

- D2C & Omnichannels: Investment in logistical infrastructure to bypass traditional retail to gain margins, leveraging offline and online touchpoints.

Key Takeaways for Furniture & Interior Design in Southeast Asia

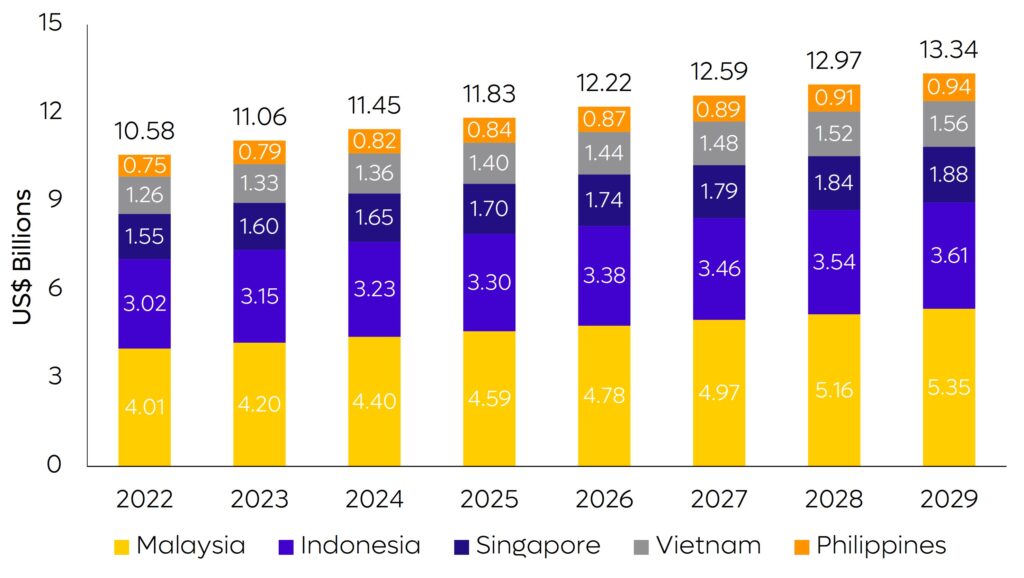

Fig 6. SEA Furniture Revenues

Figure 6 illustrates the overall SEA furniture market size in SEA6. Notably, each country is poised to grow year-on-year. As such, outlined below are four key growth drivers in the industry:

- Logistics: SEA brands underutilize technology in operations, presenting opportunities to invest in inventory, POS, CRM systems, and tech-enabled manufacturing.

- Differentiation: No current players use Interior Design software or consulting; integrating subscription-based design tools can attract clients, designers, and contractors.

- Ecosystem: Interior Design networking is underdeveloped; subscription management solutions for contractors and designers can strengthen the ecosystem.

- Brand Building: Marketplaces should create standalone brands to unlock new revenue and create thicker margins, control supply chains, and integrate advanced manufacturing.