Perspectives: Energy

A Deep Dive Into the Energy Market

Understanding Southeast Asia’s Energy Landscape Through:

- Global Energy Landscape

- Energy Access Opportunities and Relevant Business Models

- Southeast Asia Energy Landscape

The Global Energy Industry is on the Brink of Rapid Transformation

Every segment of the energy sector presents significant opportunities for sustainable solutions and technological innovation.

Energy Trends and Industry Drivers

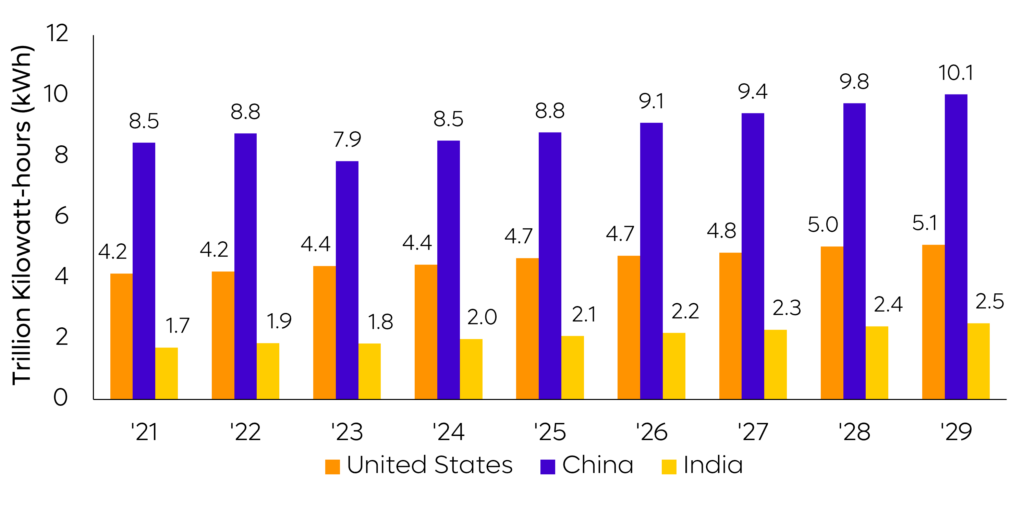

Fig 1. US China India Yearly Energy Production

Figure 1 illustrates production capacities across major global markets, with China leading in both output and consumption. As of 2023, the global energy sector is amid a pivotal shift toward integrated and sustainable infrastructure.

The global energy transition market was valued at $2.06 trillion in 2024 and is projected to grow to $6.47 trillion by 2032, representing a CAGR of 15.41%. Meanwhile, global renewable energy reached $1.21 trillion in 2023 and is expected to expand at a CAGR of 17.2% from 2024 to 2030.

These changes are being propelled by three primary forces:

- Sustainability Imperatives: Climate urgency is accelerating the adoption of clean, interconnected energy systems.

- Technological Advancements: AI-enabled energy management, improved efficiency, and declining production costs are reshaping the industry.

- Rising Energy Demand: Rapid urbanisation and industrialisation (particularly in Asia and Africa) are driving the need for modern, reliable energy infrastructure.

Energy Value Chain and Sector Definitions

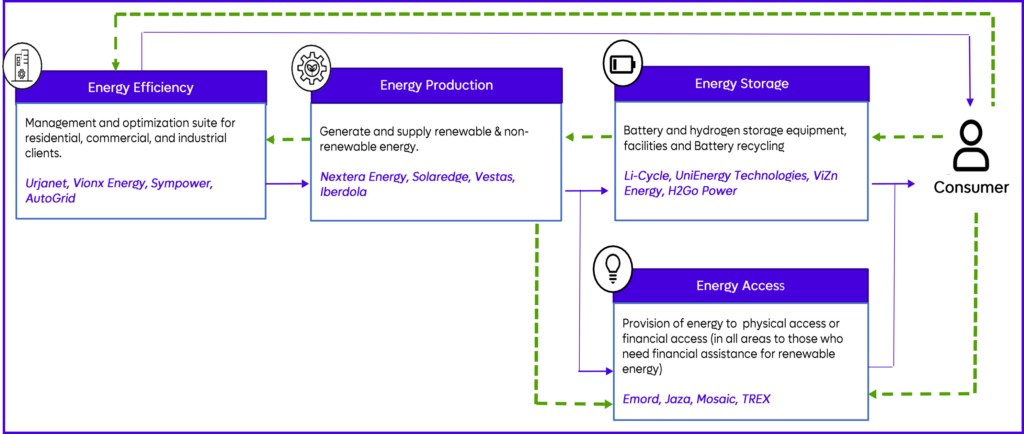

Fig 2. Energy Value Chain

Figure 2 maps the flow of goods, services, and capital across the energy ecosystem.

The value chain can be broadly divided into four key sectors:

- Energy Production: Harnessing energy from fossil fuels, renewables, nuclear, and other sources.

- Energy Storage: Capturing energy for later use through various methods to balance supply and demand.

- Energy Access: Expanding availability via cost-effective solutions, grid infrastructure, or off-grid systems such as battery storage.

- Energy Efficiency: Optimizing usage to deliver the same output with less input, reducing waste and environmental impact.

Access Shows Less Traction, but Greater Impact

Energy Access stands out for its combination of innovative business models and significant untapped market opportunities in many regions

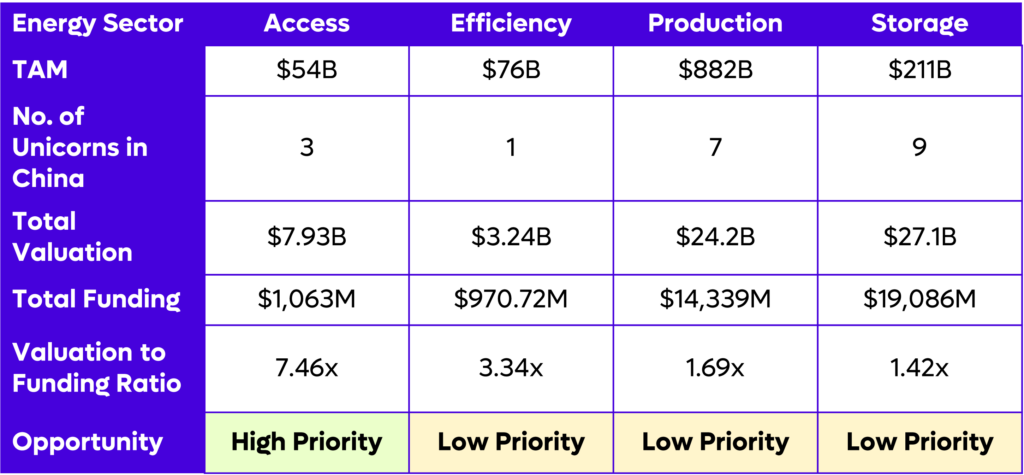

Global Takeaways of Energy Sectors

Fig 3. Sector Side-by-Side

Figure 3 compares the relative traction and activity of unicorn companies across the four primary sectors.

Our analysis of global precedents shows:

- Energy Production and Energy Storage are asset-heavy, requiring high capital investment and long development timelines before returns are realized.

- Energy Efficiency solutions tend to generate limited revenue, as their value is primarily tied to cost savings, which make up a relatively small share of the total market.

In contrast, Energy Access offers high-impact potential. Asset-light business models are emerging that can scale more rapidly and address the urgent need for affordable, reliable electricity in underserved markets.

Key Sector Insights

- Energy Access: Solutions are typically small-scale and use-case specific, such as rural electrification projects or residential rooftop solar installations.

- Energy Production: Dominated by established global incumbents, with long development and permitting cycles.

- Energy Storage: Attracts a diverse range of cross-sector players and generally requires less localization in deployment.

- Energy Efficiency: Focuses on targeted niches such as building decarbonization and industrial energy management.

Energy Access Business Models

Fig 4. Case Studies

Figure 4 profiles case studies from China’s unicorn ecosystem, demonstrating how successful energy access strategies have scaled:

- Rent-to-Own: Gradual ownership of solar systems through flexible payment plans.

- Financing & Loans: Leveraging credit scoring to offer tailored loan terms for energy-related purchases.

- Product Sales: Direct sales of solar panels, batteries, inverters, and other energy devices.

These business models address financial access barriers, creating scalable adoption pathways. Many are asset-light, enabling efficient operations with minimal localisation.

However, physical access (such as building grid extensions or deploying mini-grid systems) requires substantial capital investment and often depends on partnerships with governments or large-scale developers.

The applicability of each model varies by electrification context:

- On-grid: Lower costs but limited reach in remote areas.

- Mini-grid: Balanced scalability and cost, suited to semi-urban or clustered rural communities.

- Off-grid: Higher cost per unit, but vital for dispersed rural populations.

Underserved SEA Market is Ready for Disruption in the Energy Sector

SEA’s geography and market conditions offer strong potential for renewable energy and innovative business models, with supply and demand pressures priming the region for disruption.

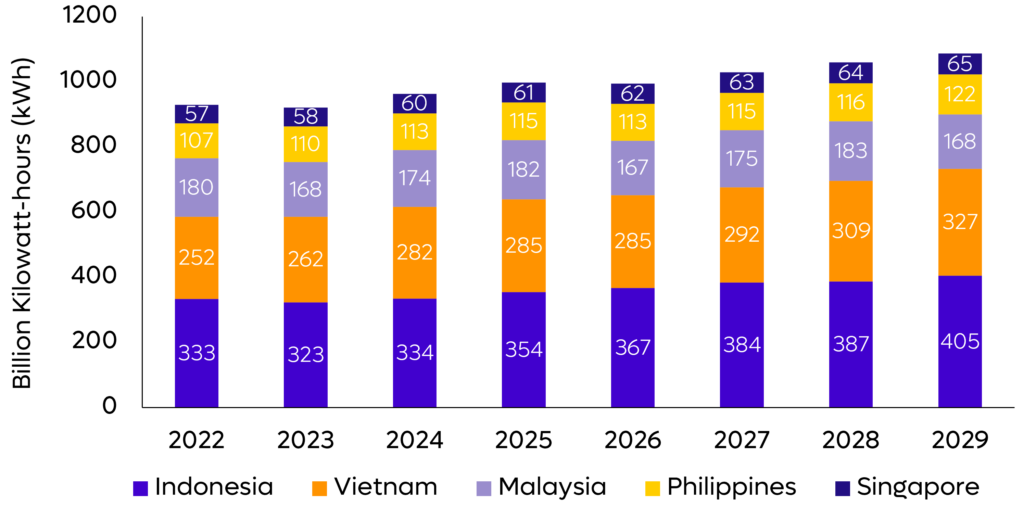

Energy Demographic Outlook in Southeast Asia

Fig 5. SEA Energy Production

Figure 5 highlights production levels, with Indonesia (334B kWh) and Vietnam (282B kWh) leading the region. Rising demand, coupled with mounting cost pressures, underscores the need for more efficient, inclusive energy systems.

Key regional insights:

- Access Gaps: Electrification remains incomplete—20% of Indonesians and 5% of Filipinos lack reliable electricity.

- Fossil Fuel Dependence: Indonesia, Malaysia, and the Philippines remain heavily reliant on coal, oil, and gas.

- Untapped Renewable Potential: Strong solar, wind, and hydro resources exist, but investment in clean energy infrastructure is still limited.

- Cost Pressures: Energy costs in the Philippines ($0.17/kWh) far exceed those in Vietnam and Indonesia ($0.09/kWh), creating affordability challenges for households and businesses.

Key Takeaways for Southeast Asia’s Energy Industry

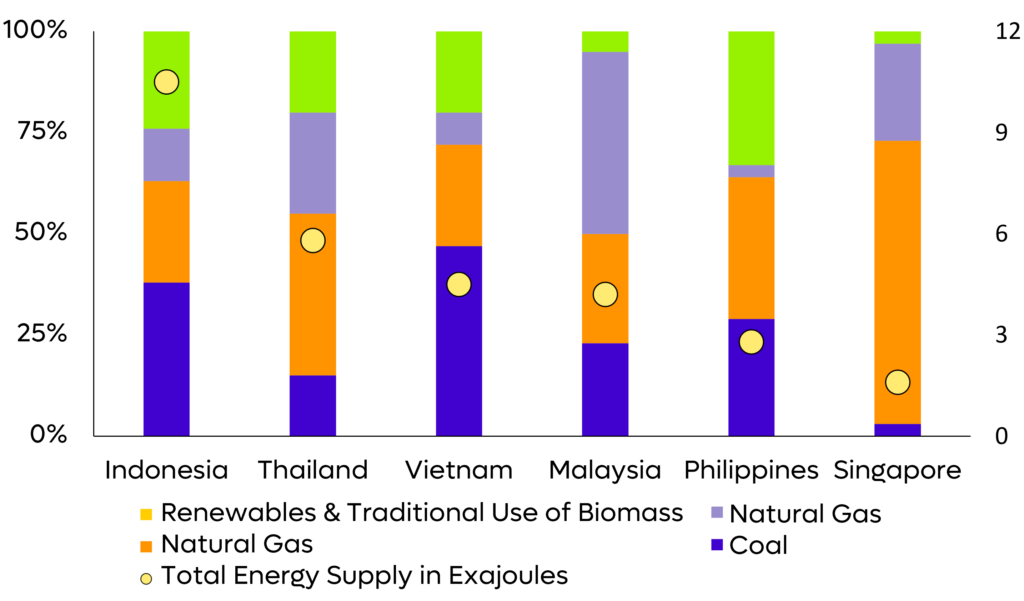

Fig 6. SEA Total Energy Supply & Production Mix

Figure 6 illustrates the region’s sustained reliance on fossil fuels alongside total national energy supply. While sustainable energy adoption is gaining momentum, key barriers, such as limited capital availability, geographic constraints, and policy hurdles, still inhibit large-scale transformation.

Yet, innovative business models can bridge these gaps, particularly in Tier 2 and Tier 3 cities where traditional infrastructure investments have lagged.

Opportunities include:

- Energy Access Expansion: Mini-grid and off-grid systems, or models that lower utility costs, will drive penetration. Strategies such as rent-to-own, tailored financing, and energy marketplaces can be adapted to each country’s infrastructure and regulatory context.

- Philippines: Well-positioned for renewable infrastructure rollouts, particularly in wind energy.

- Indonesia: High potential for clean energy adoption due to low current penetration and expansive rural markets.

- Vietnam: Northern provinces are ideal for large-scale renewable developments, particularly solar and wind projects.